A remark that stirred diplomatic waters

The U.S. President Donald Trump’s assertion that Prime Minister Narendra Modi promised to stop buying oil from Russia has sparked a rare diplomatic pushback from India. India’s Ministry of External Affairs swiftly clarified that no such conversation had taken place. The episode once again exposes India’s tightrope walk between energy pragmatism and geopolitical pressure.

Trump’s statement and India’s denial

Speaking at a Florida rally, Trump said Modi had “assured” him India would end Russian oil purchases portraying it as proof of Washington’s leverage. Within hours, India issued a categorical denial, calling the claim “baseless.” For India, rebutting the remark was crucial to prevent misunderstandings in Moscow, one of its key defence and energy partners.

Trade talks caught in the crossfire

The controversy coincides with delicate U.S.-India trade negotiations to restore market access and reduce tariffs. Washington has signalled that progress will depend on India scaling down Russian oil imports. The Trump administration’s position aligns energy with diplomacy: lowering Moscow’s revenue from oil exports is part of its broader pressure campaign over Ukraine. For India, however, oil is not about politics but affordability. Russian barrels often $6-$10 cheaper than global benchmarks, now account for roughly a third of India’s crude supply, compared with less than 2 percent before 2022. Abruptly ending those imports could strain inflation, freight costs, and refinery operations.

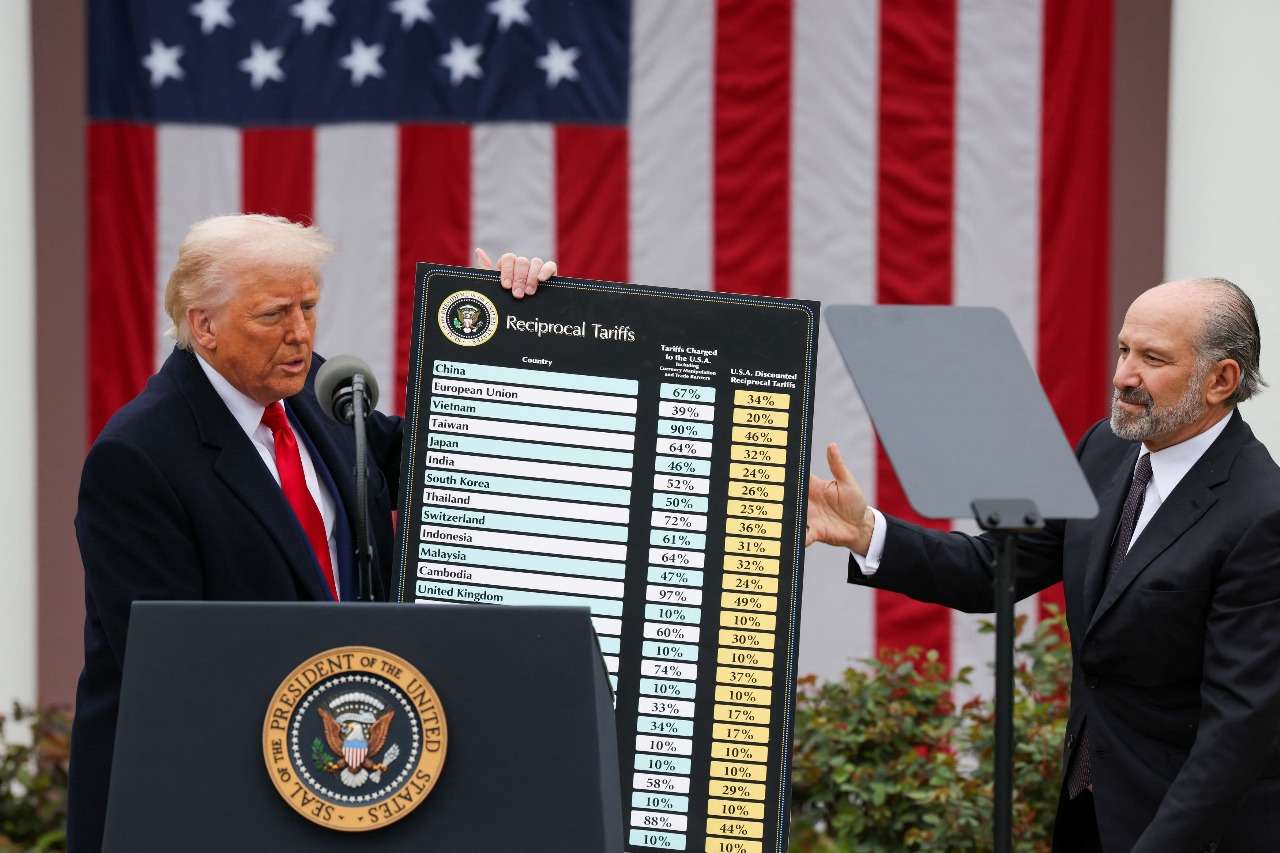

Tariffs and transactional politics

In 2024-25, the U.S. imposed up to 50 percent cumulative tariffs on Indian goods, citing “unfair energy practices.” India termed the move punitive and inconsistent with World Trade Organization norms. Trump’s latest statement seems designed to justify those tariffs or to project that India has already yielded to U.S. demands; a narrative that helps his domestic campaign. The linkage between oil and trade underscores Trump’s trademark transactional style; every concession must yield an immediate political dividend. For India, such rhetoric complicates negotiations already strained by competing priorities in agriculture, digital trade, and technology access.

Why India can’t just switch suppliers

Replacing Russian crude is neither quick nor cost-free. Indian refiners are optimized for the Urals blend, and alternative suppliers in the Middle East or the U.S. cannot instantly plug the gap without higher freight and insurance expenses. Many supply contracts are locked months ahead, leaving little flexibility. Recent dips in Russian imports about 8-10 percent since August were driven by tighter discounts and shipping costs, not policy shifts. Moscow remains India’s top supplier, followed by Iraq and Saudi Arabia.

Competing data and diplomatic optics

A White House official recently claimed India had already halved Russian oil purchases. Independent trackers contradict this, showing September imports near 1.4 million barrels per day, only slightly lower than July with early October volumes rising again. Russia’s Deputy Prime Minister Alexander Novak reaffirmed that “energy cooperation with India will continue,” suggesting confidence that commercial logic will prevail over political noise. The contrasting claims highlight how Washington and Moscow are both vying to shape the narrative.

Strategic autonomy on trial

For India, maintaining strategic autonomy remains paramount. Yielding visibly to U.S. pressure risks domestic backlash and could jeopardize long-standing defence and energy ties with Russia. Yet ignoring Washington entirely could stall the long-awaited trade deal, which promises investment and technology transfer. Officials are therefore treading carefully; avoiding public commitments while gradually diversifying imports. Purchases from the U.S., Iraq, and the UAE have risen modestly, signalling a slow rebalancing rather than a rupture with Moscow.

Beyond energy: a wider negotiation web

Oil is only one part of a broader economic dialogue encompassing market access, intellectual-property rules, and manufacturing incentives. Indian exporters argue that punitive tariffs have hurt competitiveness, while American firms seek stronger IP protections and supply-chain guarantees. Both sides recognize the strategic value of a stable trade framework, but politics continues to overshadow economics. Trump’s claim may also be aimed at domestic optics projecting firmness toward China and Russia while portraying India as a cooperative partner. India, meanwhile, must ensure that cooperation does not morph into compliance.

The path forward

India’s challenge lies in balancing perception with pragmatism. Cutting Russian oil abruptly would satisfy Washington but hurt domestic stability; resisting entirely could prolong tariff barriers and strain trade relations. The likely course is gradual diversification expanding U.S. LNG and Gulf crude imports while retaining Russian volumes at commercially viable levels. At the diplomatic level, controlling the narrative is equally vital. India will continue to assert that energy choices are guided by national interest, not geopolitical alignment. Maintaining this stance preserves credibility with both Washington and Moscow and reassures domestic constituencies that policy remains sovereign.

Between rhetoric and reality

Trump’s assertion, whether misstatement or maneuver, has placed India’s diplomacy under a sharper spotlight. The test for India lies not merely in sourcing oil, but in defending its strategic independence amid intensifying global polarization. As trade talks resume and rhetoric rises, India’s task will be to keep its diplomacy rooted in quiet realism ensuring that neither energy security nor economic growth becomes hostage to political theater abroad.