As Mauritius is focusing on elections with growing Chinese influence challenges India’s economic ties. A potential shift in government could disrupt India’s FDI, trade, and regional security. With Chinese investments rising, India must act to safeguard its interests and regional dominance.

As Mauritius approaches crucial elections, the escalating influence of China within its government poses significant challenges for India, a nation that has historically nurtured strong economic ties with the island with a surge of Chinese investments flowing into Mauritius, Indian businesses and the broader Indian economy may confront a complex and competitive landscape ahead.

The prospect of a government with strengthened Chinese affiliations could fundamentally alter the dynamics of Indian-Mauritian relations. Influential figures within the Mauritian government, such as Prime Minister Pravind Jugnauth and members of the Mauritius Labour Party (Parti Travailliste or PTR), have been recognized for their close ties to Chinese interests. These connections heighten concerns about the future trajectory of Indian investments and influence in the region.

The bilateral economic relationship exhibits notable asymmetric interdependence, with India maintaining its position as Mauritius’s third-largest trading partner. Trade volumes, while volatile, showed resilience, with exports reaching $646 million in 2023, despite previous fluctuations. This relationship is underpinned by India’s comparative advantage in key sectors, including pharmaceuticals, cotton, and mineral fuels.

Most significantly, Mauritius serves as a crucial conduit for foreign direct investment (FDI) into India, accounting for 25% of total FDI inflows ($167 billion) between April 2000 and September 2023. This positions Mauritius as a vital component in India’s capital account framework.

The Indian corporate footprint in Mauritius is substantial and diverse:

- 64 Indian companies actively operating across multiple sectors

- Prominent public sector enterprises include:

- Bank of Baroda

- Life Insurance Corporation

- State Bank of India

- Indian Oil (Mauritius) Limited

- Larsen and Toubro (L&T)

- 17,403 Indian nationals and 10,274 OCI card holders contributing to the local economy.

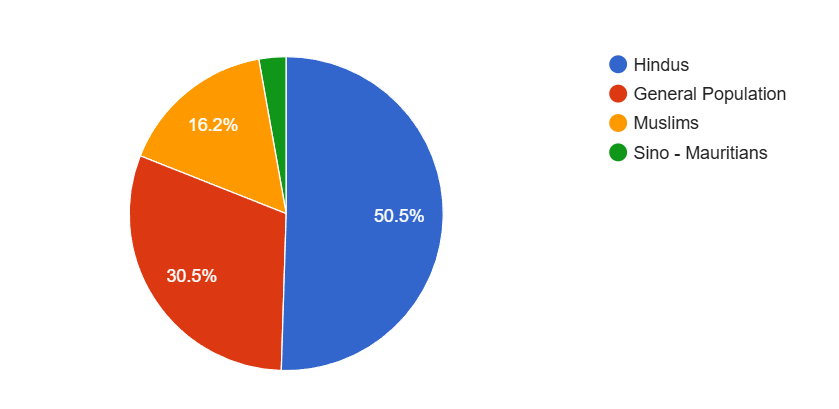

The ethnic representation in Mauritius is shown below:

Immediate Economic Vulnerabilities

The potential shift in Mauritius threatens India’s financial stability through a possible review of the Double Taxation Avoidance Agreement (DTAA) and disruption of crucial FDI routes, risking 25% of India’s foreign investments. Additionally, Chinese influence over strategic infrastructure, including ports and submarine cable networks, poses significant risks to India’s maritime trade security and naval interests in the region, potentially compromising established trade routes.

Trade and Investment Impact

- Market Access Deterioration:

- Potential preferential access for Chinese firms

- Discriminatory trade practices against Indian companies

- Reduced market share in key sectors (pharmaceuticals, textiles)

- Barriers to entry for new Indian businesses

- Investment Climate Shift:

- Redirection of investment flows towards Chinese projects

- Increased compliance costs for Indian businesses

- Regulatory framework modifications favoring Chinese entities

- Possible forced technology transfers

Geopolitical Economic Ramifications

The potential political shift in Mauritius toward Chinese influence threatens to fundamentally alter the regional economic architecture of the Indian Ocean Region (IOR). The emergence of a strengthened China-Mauritius-Africa economic corridor could significantly diminish India’s historical trade dominance in these waters. This strategic realignment would not only enhance China’s Belt and Road Initiative but could also create a parallel economic ecosystem that bypasses traditional Indian trade routes. As Mauritius serves as a crucial gateway to African markets, this shift could severely impact India’s market access and trade leverage across the continent.

India’s economic influence faces critical challenges beyond trade relationships. The rising dominance of the Chinese yuan in regional settlements threatens India’s rupee internationalization efforts and Mumbai’s position as a financial hub. The traditional Mauritius investment route, crucial for India’s offshore financial services, could shift toward Chinese channels, fundamentally altering regional financial dynamics.

The reduced presence in Mauritius poses risks to India’s economic intelligence capabilities, potentially weakening its position in trade negotiations and market monitoring. Mumbai’s financial sector faces direct competition from a Chinese-influenced Mauritian financial centre, threatening established regulatory frameworks and investment flows.

To protect its interests, India must strengthen alternative financial centres, diversify trade routes, and enhance economic surveillance capabilities through strategic partnerships and diplomatic initiatives.

Critical Sector Vulnerabilities in Indo-Mauritian Relations

Indian banks face mounting pressure in Mauritius with potential market share erosion due to the expansion of Chinese financial institutions. This threatens existing lending portfolios and retail banking operations. Similarly, the IT sector confronts significant challenges through data security risks, market access restrictions, and forced adoption of Chinese technology standards, potentially limiting collaborative opportunities and technological growth for Indian firms.

This scenario requires careful preparation and strategic foresight to protect India’s economic interests. The potential shift in Mauritius’s political alignment could significantly impact India’s economic security, necessitating comprehensive contingency planning and rapid response capabilities. Continuous monitoring and adaptive response strategies will be crucial for maintaining India’s economic interests in the face of changing geopolitical dynamics.

The potential PTR victory in Mauritius represents a critical political challenge for India, threatening its traditional influence in the Indian Ocean Region.

Following recent setbacks in the Maldives and Bangladesh, losing Mauritius to Chinese influence would severely undermine India’s regional dominance, requiring urgent diplomatic intervention to protect its strategic interests. Swift action is necessary to protect Indian economic interests, including strengthening alternative financial centres, diversifying trade routes, and enhancing economic surveillance capabilities. The outcome will significantly impact India’s economic security and regional influence, making a strategic response crucial for maintaining its position in this vital region.