In today’s digital and green economy, rare earth elements (REEs) are as valuable as gold-if not more. They power everything from electric vehicles to wind turbines, smartphones, and defence systems. The only issue is that over 85% of the global processing of rare earths is done in China. The fact that they control so much of the global supply chain has subjected the world to geopolitical risks, meaning India, amid its rise to prominence as a tech and manufacturing centre – is aware that it needs to act. India, currently the world’s most populous country and a growing tech competitor, understands it can’t rely solely on one supplier. India is working to harness domestic supply chains across minerals and energy sources with growing electric vehicle (EV) markets, an active defence industry, and big renewable energy targets – everything possible with rare earths and minerals.

Rare Earth Elements: Diplomacy and Global Partnerships

India’s first message is clear: build global coalitions and lessen reliance on single sources. At the recent summit of BRICS leaders, Prime Minister Narendra Modi clearly called for equitable and multipolar supply chains, a veiled but pointed criticism at China’s dominance of rare earth elements (REE). The world needs alternatives, and India is ready to help lead the way. India is going beyond rhetoric and is getting into action. India is securing critical supply relationships with countries like the U.S., Australia and Japan through efforts such as the Quad Critical Minerals Initiative and the U.S.-led Minerals Security Partnership (MSP). These partnerships give India access to not only upstream resources, but also the advanced processing technology needed to establish its own rare earth elements value chain.

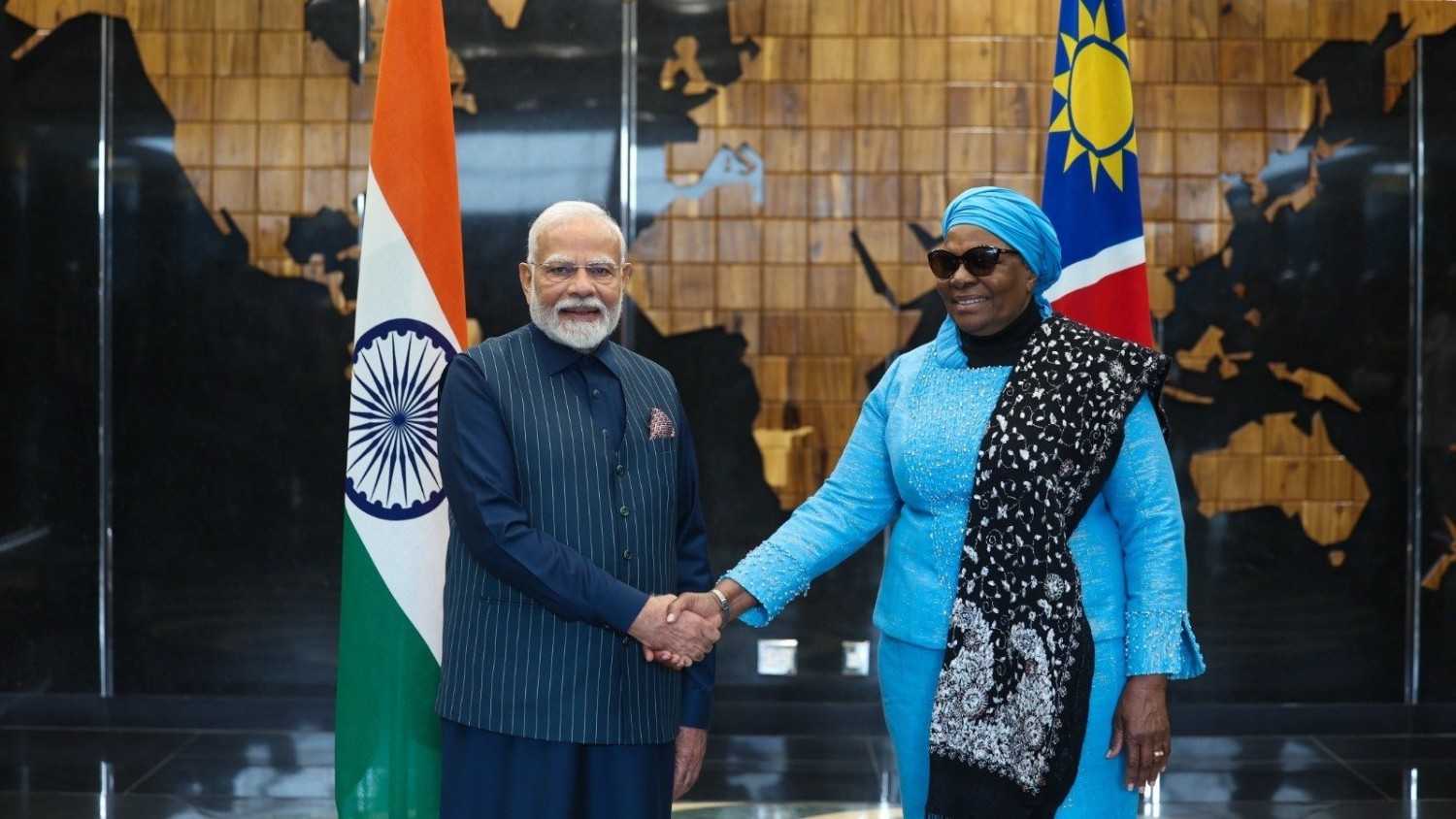

PM Modi’s Recent Visit Boosts India’s Global Quest for Rare Earth Elements

Prime Minister Narendra Modi’s July 9 trip to Namibia is an important milestone, part of India’s emergent global strategy to capture critical minerals such as lithium, cobalt, uranium, and rare earths that are necessary for the technology revolution and clean energy ambitions of the country. Namibia offers a rich opportunity, as the country hosts the world’s third-largest uranium reserves and is emerging as a key partner while there is increasingly interest in green hydrogen.

At the same time India is forging new mineral ties globally: in Zambia, it is exploring 9,000 sq. km of cobalt and copper resources needed for electric vehicles and clean tech; in Argentina, it is entering some very significant lithium deals with the holder of the world’s second largest lithium reserves; in Ghana, it is channelling mineral exploration on the ground with its partnerships providing access to further resource locations in Africa; in the Democratic Republic of Congo (DRC), it is accessing 70% of the world’s cobalt reserves, essential to battery and renewable technologies; and in Trinidad & Tobago, it has expanded the scope of its renewed MoU in 2025 to include collaboration on rare earths and energy resource mapping further extending India’s mineral security horizon.

India’s $2 Billion Rare Earth Elements Push

Domestic India isn’t just talking about critical minerals; on the home front, it is investing heavily. The National Critical Mineral Mission has been announced with a budget of ₹16,300 crores (approx. $2 billion). It can best be described as a seven-year plan, that promises to kickstart exploration, enable recycling and bring private actors into the sector. Effectively, it moves away from the state monopolies to a competitive state-based mining ecosystem, alongside other private investment actors. State-owned IREL (India) Limited is already increasing production, particularly in Odisha and Kerala. Exports of REEs are stopped to have supply in the country. Now, the focus is value addition. As an example, India plans to produce 450 tonnes of neodymium by 2026 and then double that by 2030. Neodymium is the metal that powers the high strength magnets used in EVs and defence systems, so again, this target is strategic and not just aspirational.

Global Sourcing Strategy: Looking Beyond China

India’s rare earth plan is not just bilateral, it is global. In addition to Latin America and Africa, India is establishing mineral partnerships with Australia, a fellow democracy with significant mineral endowments. Discussions are occurring over the joint development of REE and copper blocks that can supply the national needs of both nations. Additionally, India is looking for partnerships in Central Asia, Vietnam, Myanmar, Chile, and the EU, to create a strategic and resilient web of REE supply chains with geopolitical security through diversification. This proactive diplomacy ensures India won’t be caught off guard by any single nation’s export restrictions or political turbulence.

Conclusion

India’s strategic push into rare earths signals a bold aspiration of self-reliance and global leadership in future technologies. Rare earth elements are essential to power the demand of India’s future electric vehicles (EVs), electronics and defence sectors, which are projected to demand around $2 billion in 2030 to as high as $7 billion in 2040. More importantly, India’s continued integration of diplomacy, industrial policy and scientific innovation will put it on a path of eventual mineral independence. While it will take some time for India to come up to par with China’s dominance of rare earth elements, India’s commitment and resolve is already evident. If India is to maintain this momentum, it will enhance its status and credibility as a trusted global supplier and key participant in the future rare earth’s ecosystem.

Frequently Asked Questions (FAQs):

1. Why is India focusing on rare earth elements?

India is focusing on rare earth elements to support its growing needs in electric vehicles, defense, electronics, and renewable energy, while reducing dependence on China.

2. What is the National Critical Mineral Mission?

It’s a ₹16,300 crore, seven-year initiative aimed at boosting exploration, domestic production, recycling, and private sector participation in critical minerals.

3. How is India securing rare earth supplies globally?

India is forming strategic partnerships with countries like Namibia, Zambia, Argentina, and Australia to access lithium, cobalt, uranium, and other critical resources.