U.S. President Donald Trump’s “reciprocal tariffs”, set to take effect on April 2, 2025, signal a major shift in India-U.S. trade relations. With India’s growing trade surplus and U.S. plans for tariff hikes, concerns over economic stability and bilateral agreements have intensified. India and the U.S. have shared strong trade ties for decades with recent tensions under Trump’s trade policies, this article explores their impact on key industries and how India can strategically adapt to sustain long-term growth.

India-U.S. Trade Under Trump’s Tariff War

The trade policies of the U.S. President Donald Trump significantly altered global economic relations, with India among the countries most affected. The key aspect of the approach is the imposition of reciprocal tariffs, which were the main component of this approach to correct trade imbalances. In a Speech at the White House, Donald Trump labeled India as a “Tariff Abuser” criticizing its high tariff on American Goods and highlighting the trade imbalances between the two countries. Both Nations assert their economic interests, and implementing reciprocal tariffs has raised concerns over economic stability and uncertainty in Indo-U.S. bilateral trade relations.

Economic Vulnerability and Trade Surplus

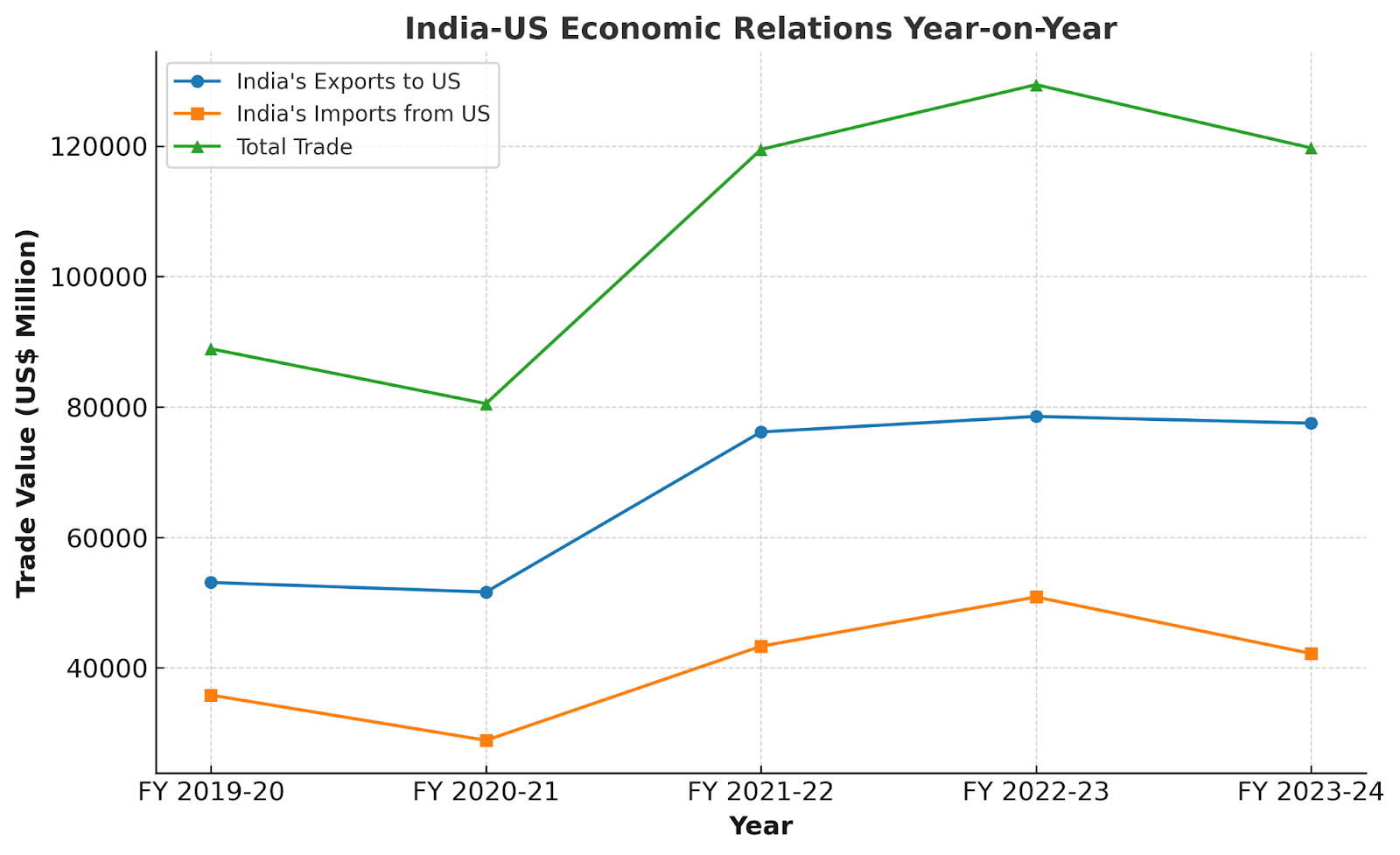

In 2024, U.S. Exports to India marked 41.8 Billion Dollars, reflecting a 3.4 Percent increase from 2023. India’s trade surplus with the U.S. has grown significantly from $25 billion to $38 billion and $45 billion in recent years. The enormous surplus puts India at risk of higher U.S. tariffs potentially leading to trade disruptions, as it is one of the key trade partners across the globe. The International Monetary Fund (IMF) projects global GDP growth at 3.3% for 2025, below the pre-pandemic average of 3.7%. Previous occurrences, like the 2019 U.S.-China trade war caused a decline in global GDP growth by 0.8%, indicating that Indo-U.S. trade tensions may have comparable consequences.

Key Projects Influenced by Trade Tensions

The Indo-U.S. trade tensions threaten key projects across defense, technology and energy sectors. These projects are crucial for India’s long term self reliance in manufacturing and infrastructure development. The GE-HAL jet engine deal, India’s fighter jet program depends heavily on U.S technology transfers, trade restrictions could weaken India’s defence capabilities. Similarly, the Boeing-Tata defense partnership, a joint venture focused on manufacturing military aircraft components, may face cost escalations due to tariffs on raw materials or supply chain disruptions. In semiconductors, the $2.75 billion Micron plant in Gujarat is vulnerable to the U.S. Chips Act’s impact on supply chains, as a 25% U.S. import tariff on semiconductors could impact component costs. This poses a major risk for Apple’s iPhone production shift to India, where key suppliers like Foxconn, Pegatron, and Wistron depend on a smooth Indo-U.S. semiconductor trade. According to Barclays Finished smartphones entering India currently face a 16%-20% tariff, whereas tariffs on Indian phones sold into the U.S. are at 0%, and as a result India will likely drive iPhones prices up.

Impact of Reciprocal Tariffs on Key Sectors

Impact of Reciprocal Tariffs on Key Sectors

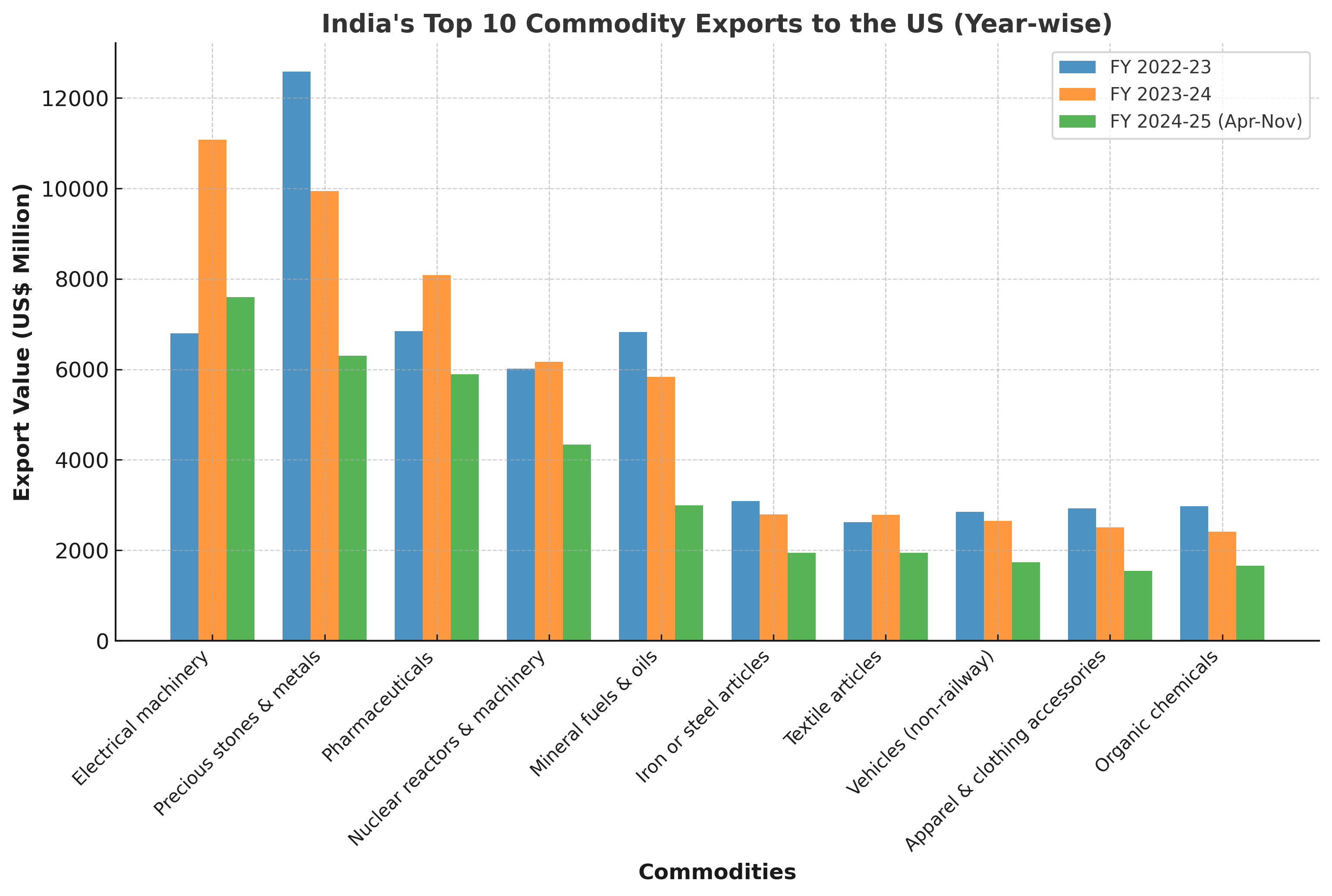

On April 2, 2025, the U.S. plans to announce its decision on whether it will increase tariffs (taxes) on products imported from India. Right now, experts say that India charges higher taxes on American goods — about 4.9% to 8% more than the U.S. charges on Indian products. Agriculture and Automobiles will face an increase in Tariff around 25%, making them less competitive in the U.S Market. Taxes on Aluminium will rise 10% to 25%, affecting the supply chain. India being the leading supplier in the Pharmaceutical sector, nearly 40% of the U.S. generic drugs, increase in tariff rates on this sector, leads to higher medicine costs and disrupts the supply chain and global healthcare access. High tariff on jewellery potentially leads to job loss, where India’s 10 billion dollar exports in this industry will be subject to 5% to 20% of tariff. If the U.S. decides to match India’s higher rates, Indian exports to the U.S. could drop by around $7 billion. That’s about 1% of India’s total exports.

Conclusion

India has historically navigated global trade shifts and countered U.S. tariffs with strategic diplomacy. India has countered past trade disputes with retaliatory tariffs, like its 2018 move against U.S. duties on steel and aluminum. Prior trade conflicts have been lessened by the nation’s proactive policy changes, export market diversification, and strengthening of domestic manufacturing. “India-U.S. have set an aim of doubling their bilateral trade to $500 billion by 2030 and will work on finishing a mutually beneficial trade agreement very soon,” Prime Minister Narendra Modi said during his visit to the United States. To ensure long-term economic stability, India must foster trade ties with Southeast Asia, Africa, and Latin America while decreasing dependency on the United States, Strengthening diplomatic ties and advancing negotiations for a U.S.-India Free trade agreement will curb trade tensions. Strategic policy adaptability and diplomacy will strengthen India’s economy, ensuring sustained growth amid evolving challenges.